What is Scalping Definition and Meaning

Contents:

Unlike events that play out over a more extended period, scalp traders rely heavily on short-term events that drive increased interest in assets due to some news. High-frequency scalping is usually executed through trading robots or expert advisors, as the positions are held for no longer than a minute. Medium-term scalping is referred to active trading strategies with 5-10 minutes per trade, while conservative scalping is referred to 30 minutes per trade. Gamma scalping is an options trading strategy that does not focus on market direction.

But, you stand to gain substantial profits through these short-term price swings. The low time commitment is one of the main reasons traders love this style. It’s great for those who work a full or part-time job and just want to trade on the side. You aren’t stuck watching charts all day like you would be with day trading – or scalp trading, as you’re about to learn.

Scalping offers potential benefits, including the possibility of quick profits, no overnight risk, and high trading volume. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. Many traditional chart patterns, such as cups and handles or triangles, can also be used for scalp trading. The goal of a scalper is not to make an enormous profit with each individual trade they make, but rather to make a small profit over many little trades.

This shows that there is a brief pullback taking place after a short-term market peak overbought state. The standard deviation measures the space between the upper and lower bands or the sum of the standard deviation. This part of the indicator can be used to spot fluctuations in market volatility when they occur. This technique is most successful on one-minute and five-minute timeframes; however, it may be fine-tuned to operate on longer periods if necessary. It is critical that you configure these indicators correctly and keep an eye on them since they are key signals that tell you when to open a long order and when to open a short order.

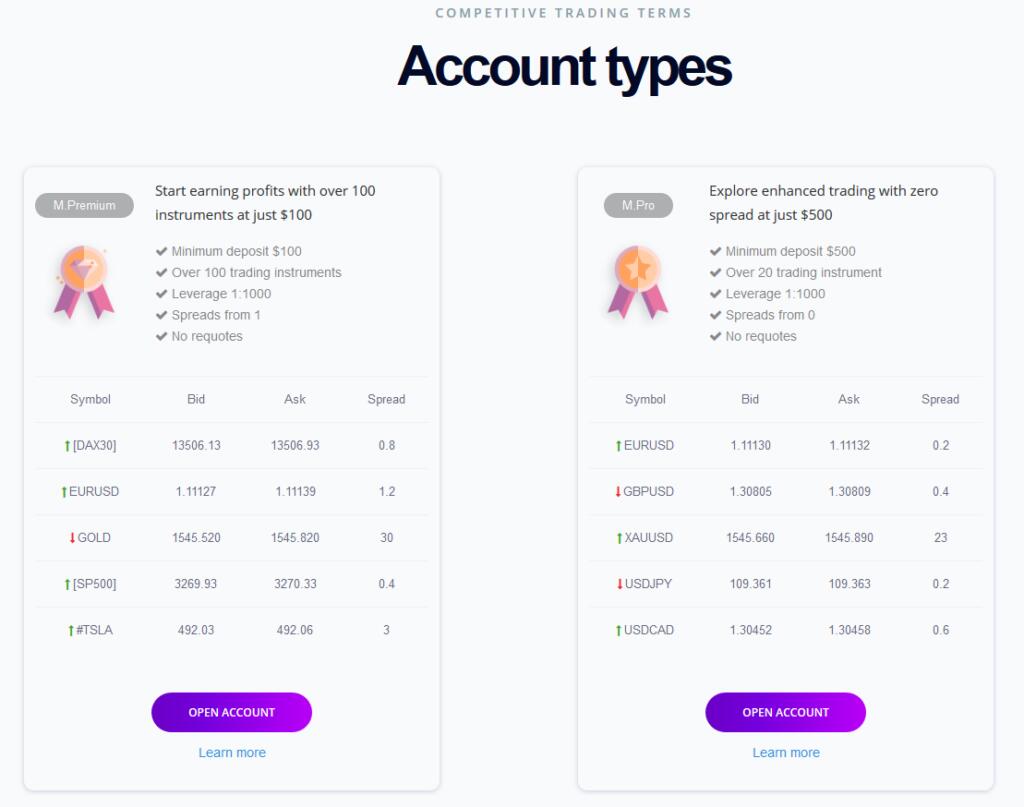

Get tight spreads, no hidden fees and access to 10,000+ instruments. Blockchain redefines the financial system we thought we knew and has overall changed the way we see money. Update it to the latest version or try another one for a safer, more comfortable and productive trading experience.

An Overview of The Long Order (Purchasing) Entry

Futures trading involves the substantial risk of loss and is not suitable for all investors. All this can limit your exposure to risk while creating the framework for your profits to slowly https://1investing.in/ add up. In this article, we have covered everything you need to know about scalping in crypto trading. You may want to test the environment with virtual money with a Demo account.

While the main trade develops, a trader identifies new setups in a shorter time frame in the direction of the main trade, entering and exiting them by the principles of scalping. When scalpers trade, they want to profit off the changes in a security’s bid-ask spread. That’s the difference between the price a broker will buy a security from a scalper and the price the broker will sell it to the scalper. With the intuitive interface layouts and institutional quality stock and options scanners, we aim to help traders reach their goals, no matter what their strategy is. We also offer our clients some of the lowest trading fees in the industry.

Pros and Cons of Stock Scalping

As for those who answered «yes» just once – you are probably considering this approach for now. Nevertheless, the forex trading strategies we will explain below are accessible and understandable. We believe anyone of you may try them out and see how effective they are. On the other hand, scalpers mainly focus on the M1-M15 timeframes and deal with higher risks and larger trade sizes.

- Therefore, a scalper must have steel nerves and follow the market carefully.

- Traders who adopt this strategy are known as scalpers and can place around 10 to a few hundred trades on an average day, with sessions lasting anywhere between a few seconds to an hour.

- Scalping Forex or any financial instrument for a living requires discipline and skills to analyse the market on very short timeframes.

- A day trader, for example, might look to open 5-10 positions over a single session.

Furthermore, scalping frequently requires advanced analytical skills, although traders do not necessarily need to be patient with consistent price fluctuations. In addition, please bear in mind trading fees, which may be high, depending upon your trading volume. Alternatively, you can practise scalping with a free City Index demo.

Sign up to our exclusive Q2 Market Outlook now

You can also open a longer time chart on the side to help monitor market trends, which may result in even more accurate trades. The Bollinger band lines are made up of three different indicators, each used to obtain information about the market’s current condition. These indicators show the market’s trend, volatility, and high and low price anomalies.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. These are just a few of the questions you’ll need to ask yourself before deciding. Let’s compare and contrast the unique differences these styles have to help you make the right choice – starting with profits.

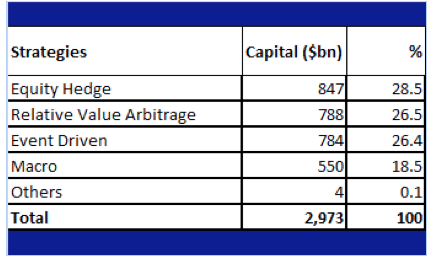

Companies like Robinhood, WeBull, and Schwab that offer free trading experience have also made it relatively attractive for people to trade. In addition, high-frequency trading requires a powerful computer, ultra-high-speed internet, complex algorithmic trading software, and servers often located near an exchange. For this reason, high-frequency trading is practiced by scalping meaning in trading large financial institutions (e.g., hedge funds) rather than retail investors. Enjoy reliable, multilingual support during business hours via chat, email, or direct phone calls to your personal account manager. High Drawdown Potential – Scalping tends to be done using relatively higher lot sizes. This means that a series of losses can leave a big dent in your capital.

No Rollover or Swap Fees – There are no other extra charges apart from spreads because no trade is left running overnight. Whenever the spread is made one party must pay it and some party will receive that money as profit. Investopedia requires writers to use primary sources to support their work.

Scalping Decision Factors

Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Emily Norris is the managing editor of Traders Reserve; she has 10+ years of experience in financial publishing and editing and is an expert on business, personal finance, and trading. Equities, equities options, and commodity futures products and services are offered by Lightspeed Financial Services Group LLC .

If a trader remains involved in a trade when the price declines, they may incur a loss. Scalp traders generally have more conservative price targets than momentum traders. Whereas momentum traders aim to capture “the meat of the move,” scalp traders just want a small piece of the action. To offset the risk of holding a larger position , you must trim the holding time. To offset, the risk of holding time, you can trim the position size.

The trader will buy and sell a massive tranche of ABC shares, say 50,000, and sell them during opportune price movements of small amounts. For example, they might choose to buy and sell in price increments of $0.05, making small profits that add up at the end of the day because they are making the purchase and sale in bulk. Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. As a technique, scalping requires frequent entry and exit decisions within a short time frame. Such a strategy can only be successfully implemented when orders can be filled, and this depends on liquiditylevels.

Scalping forex is a style of trading the currency markets that involves making lots of extremely short-term positions each day, targeting small profit margins from each one. Essentially, you’re looking to make money on tiny ‘micro trends’. You open your position as one begins and close it the moment it turns against you. For example, some key economic indicators that impact the price of foreign currencies include inflation, economic growth, supply and demand, trade status, interest rates and account balance. Those involved in scalp trading generate trade ideas using technical analysis . It’s a type of analysis that allows traders to predict future market behavior based on previous price movements and volume data.