GBP currency pairs price list and quotes

Content

The symbol £ was retained for the pound sterling, and the letter p was chosen for the new penny. You can send a variety of international currencies to multiple countries reliably, quickly, and safely, and at a rate cheaper than most banks. The British pound is the second most used currency in world trade in terms of its global use.

If you request the exchange at any of these bureaux de change, they will send you the money to your address without any surcharges. Currently, Civitatis has an agreement with Ria, so if you wish to exchange your money with them you can get a discount with the code “civitatis”. The 5 pound note, the 10 pound note, the 20 pound note and the 50 pound note. The symbol for the penny is «p»; hence an amount such as 50p is often pronounced «fifty pee» rather than «fifty pence». In 2023, the rate climbed up again, whereby from March 2023 to June 2023 it had a steady increase, sitting at approximately $1.28 by the middle of June.

The most common currency pairs involving the British pound are the euro (EUR/GBP) and the U.S. dollar (GBP/USD). Internationally they are considered local issues of sterling so do not have ISO 4217 codes. «GBP» is usually used to represent all of them; informal abbreviations resembling ISO codes are used where the distinction is important. In 1816, a new silver coinage was introduced in denominations of 6d, 1/–, 2/6d (half-crown) and 5/– (crown). It was followed by a new gold coinage in 1817 consisting of 10/– and £1 coins, known as the half sovereign and sovereign.

What Is the GBP?

The pound was first used as the official currency of the Great Britain in 1558. The pound sterling is the fourth-most-traded currency in the world, with a daily trading volume of more than $1.8 billion. The pound sterling declined again in Sept. 2022 after Prime Minister Liz Truss announced economic policies on tax cuts. Economic productivity, investors and forex traders were concerned that tax cuts would increase already-high inflation and debt. The GBP/USD sank to an all-time low of 1.03 on Sept. 26, 2022. Following the restoration of the monarchy in 1660, the coinage was reformed, with the ending of production of hammered coins in 1662.

The gold standard offered a uniform way to determine value among world currencies. Before World War I, the United Kingdom used the gold standard to set the value of the British pound. Unlike banknotes which have separate issuers in Scotland and Northern Ireland, all British coins are issued by the Royal Mint, an independent enterprise (wholly owned by the Treasury) which also mints coins for other countries.

How long does it take to transfer USD to GBP online?

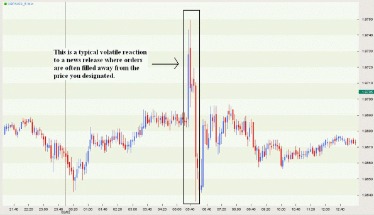

Until 1855, when printing began, the Bank of England wrote all banknotes by hand. You can trade GBP and USD, along with any other currency pairing, through a forex broker. A forex broker is just like a stock brokerage, except they focus on foreign exchange products. Intra-day trading strategies do not involve holding the position for more than one day. These strategies include placing trades in a shorter time, such as the intra-day time frame. These strategies also involve placing trades in the middle of the trading day.

- In medieval Latin documents the words libra, solidus, and denarius were used to denote the pound, shilling, and penny, which gave rise to the use of the symbols £, s., and d.

- The symbol for the penny is «p»; hence an amount such as 50p is often pronounced «fifty pee» rather than «fifty pence».

- Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate.

- The Conservative and Liberal Democrat coalition government (2010–2015) ruled out joining the euro for that parliamentary term.

- The GBP/USD sank to an all-time low of 1.03 on Sept. 26, 2022.

- According to the International Monetary Fund (IMF), the pound has settled into fourth place, trailing the Japanese yen (JPY).

The factors that affect the strength of the UK economy are largely the same as those that affect the European economy, which the UK is a part of, and those that affect the US economy. The currency of all the Crown Dependencies and most British Overseas Territories is either sterling or is pegged to sterling at par.

GBP/DOGE

We offer competitive exchange rates, so you can save money compared to high-street banks. With access to a dedicated account manager, you can discuss your overseas payment goals and they can guide you on your pounds to euros payment and other currency needs. GBP/USD refers to the currency pair of the U.S. dollar and the British pound, which is among the most widely traded in the world. The current value of the GBP/USD pair shows how many U.S. dollars are needed to purchase one British pound. Many factors affect the GBP/USD rate, including economic indicators and actions by the central banks in both countries to boost or devalue their currency. Range-based strategies involve placing trades when the price of the underlying currency pair is near the top of its trading range or the bottom of its trading range.

Once the investor has a handle on the fundamentals of the British pound, the investor will be able to make more informed trading decisions and be more likely to make more money in the Forex market. Any Forex trader interested in trading the British pound should do their homework to get a handle on the fundamentals of the pound. The pound is one of the most used currencies in the world and the third most widely held currency. There is approximately USD one trillion worth of British pound assets in existence.

Strategies for Trading the British Pound

Pound notes started to circulate in England in 1694, shortly after the establishment of the Bank of England, and the notes were originally handwritten. The pound worked in its complex scheme of pennies and shillings until 1971, when the decimal system was introduced. Mid-term trading strategies typically involve holding the position for longer than one day, up to one week. https://g-markets.net/helpful-articles/how-to-spot-fake-double-tops/ The following strategies work best when the trader expects the position to move in the trader’s anticipated direction over the course of a week. Short-term trading strategies typically involve holding the position for less than one day. The following strategies work best when the trader expects the position to move in the trader’s anticipated direction within a day.

- There is approximately USD one trillion worth of British pound assets in existence.

- Foreign exchange traders can trade the British pound with a wide variety of technical and fundamental analysis tools and a number of different trading strategies.

- Coin minting was mechanized in 1660, and features such as side lettering were introduced in its design to help eliminate money-clipping.

- In 1848, the 2/– florin was introduced, followed by the short-lived double florin in 1887.

These circulated until 1928 when they were replaced by Bank of England notes. Irish independence reduced the number of Irish banks issuing sterling notes to five operating in Northern Ireland. The Second World War had a drastic effect on the note production of the Bank of England. Fearful of mass forgery by the Nazis (see Operation Bernhard), all notes for £10 and above ceased production, leaving the bank to issue only 10/–, £1 and £5 notes. Scottish and Northern Irish issues were unaffected, with issues in denominations of £1, £5, £10, £20, £50 and £100.

pound sterling

Its gold basis remained unsettled, however, until the gold guinea was fixed at 21 shillings in 1717. The easiest option is to withdraw pounds directly from any ATM in London. This is also the cheapest option, since it has a lower exchange rate. In order to convert British pounds into U.S. dollars, simply multiply the number of pounds by the GBP/USD exchange rate on the day of conversion. For example, if you were converting 800 British pounds into U.S. dollars on June 17, 2023, you would multiply £800 x $1.28 (the exchange rate for the day) to get $1,024. To convert from dollars to pounds, you would simply divide by the exchange rate, rather than multiply.

The Bank of England is the central bank for sterling, issuing its own banknotes, and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issued by other jurisdictions are not regulated by the Bank of England; their governments guarantee convertibility at par. Historically, sterling was also used to varying degrees by the colonies and territories of the British Empire. It is the fourth most traded currency, behind the US dollar, the Japanese yen, and the euro. Crown Dependencies, the Bank of England does not govern the Jersey pound, the Manx pound, and the Guernsey pound and are distributed separately. However, they are held at a set exchange rate by their national governments, and the Bank of England notes remain in use on the islands, creating a kind of one-way legally recognized currency union.

Government to set the British pound’s monetary policy by regulating the supply of money. It exercises control over the issuance of banknotes in Wales and England and controls the flow of banknotes issued by seven approved banks in Northern Ireland and Scotland. The Bank of England issues the pound sterling, prints its own banknotes, and controls the issuance of banknotes by private banks in Northern Ireland and Scotland. Sterling notes issued by other jurisdictions are not governed by the Bank of England. The GBP, or British pound sterling, is the official currency of the United Kingdom.

The GBP is the oldest currency in the world that is still used as legal tender. Symbolized by the pound sign (£), the GBP has one of the highest trading volumes in the world. The British pound became the official currency of the United Kingdom when England and Scotland united to form a single country in 1707, but the pound was used as a form of money in the year 760.