Prepaid Rent: Asset or Liability?

Non-current assets (long-term) and current assets (short-term) are categories of assets owned by an entity. The current assets are the short-term assets that can be quickly converted into cash. BlackLine and our ecosystem of software and cloud partners work Prepaid Rent Accounting together to transform our joint customers’ finance and accounting processes. Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company.

The periodic lease expense for an operating lease under ASC 842 is the product of the total cash payments due for a lease contract divided by the total number of periods in the lease term. If all details of a contract are the same, organizations record the same amount for lease expense under ASC 842 as they would for rent expense under ASC 840. Sometimes, your accounting software can handle the amortization expense creation process, so your monthly journal entries will be completed automatically. If you’re using manual ledgers for your accounting, you can create a spreadsheet outlining your monthly expenses that will need to be recorded in your general ledger as an adjusting entry.

Accounting for base rent with journal entries

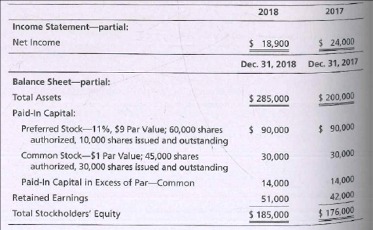

You pay the prepaid rental before the rental period, and landlords require this as a condition of the lease agreement. Since prepaid rent is found on the balance https://kelleysbookkeeping.com/how-does-a-limited-liability-company-llc-pay-taxes/ sheet as an asset, it is a permanent account. However, once the prepaid rent has been used up, the expense is recorded on the income statement as rent expense.

If you’re using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee. First, Jill will need to record the initial payment to her attorney for $3,000. If you’re creating a spreadsheet to track your monthly expense, it would look like this.

Prepaid rent accounting

This allocation is thereby documented as a type of prepayment in the current account of a firm’s balance sheet. In other words, unless the value of the asset is not realised until 12 months have passed, prepaid expenses have to be recorded as a current asset. Meanwhile, prepaid expenses are not eligible for tax deductions since the benefits will not be incurred within the same financial year, as that would not be in compliance with the GAAP standards. One thing that is very important to note when recording prepaid rent is to not forget to shift the prepaid rent into an expense account in the exact month that the rent is consumed.

Sale-Leaseback Transactions Under the New Accounting Standards – eisneramper.com

Sale-Leaseback Transactions Under the New Accounting Standards.

Posted: Fri, 26 Aug 2022 07:00:00 GMT [source]

Whether it is classified as a current or long-term asset depends on the length of the lease term. Therefore, as the benefits of the prepaid rent are realized, it is recorded on the income statement. Then, this security deposit upon the satisfaction of certain conditions can be refundable at the end of the lease.

How organizations can ensure they account for prepaid correctly?

This allocation is represented as a prepayment in a current account on the balance sheet of the company. Your next step would be to record the insurance expense for the next 12 months. You may be able to set up a recurring journal entry in your accounting software that will complete this automatically. If not, you’ll need to create an amortization schedule to help you determine how much you need to pay each month and for how many months.

Hence, the printer ought to be noted down as an expense over the period in which its benefit has been fully realised. In that case, the prepaid rent is recorded in the period when the cash is paid. The effect of these entries is also recorded in the company’s income statement and the balance sheet. In the period when prepaid rent is paid but not due, there will be no record in the income statement. The increase of prepaid rent assets is against the decrease of another asset (cash/bank).

Leave a Reply